Understanding the esports ecosystem: fans, sponsors, and the future

Elevent recently conducted a comprehensive survey of 2,000 adults (18+) in the U.S. designed to uncover the impact of sports sponsorship on consumer perspectives.

Esports fanbase in the US: A closer look

Esports commands a considerable following, with a declared fanbase of 28% in the U.S.—16% being avid fans and the remaining 12% being casual or occasional fans.

The gaming connection

While esports is intrinsically tied to video games, it’s interesting to note that not all esports fans are gamers. Among this fanbase, 69% enjoy playing video games, compared to just 41% of the general population. This statistic falls right below “spending time with my children,” which stands at 45%!

Demographics of the Esports fan

Unsurprisingly, the esports audience skews young, significantly over-indexing in age groups between 18 and 44. Esports fans are more likely to be employed full-time (+30%), to hold a university degree (+15%), and to be higher earners. Almost half (46%) earn above $100,000, compared to 26% of other respondents. They are also more likely to be married (+12%) and less likely to be divorced (-9%).

The audience is predominantly male, with a male-to-female ratio of 72:28.

Lifestyle preferences of Esports fans

Esports fans are less likely to partake in activities like eating out, going to bars, and reading. However, they are more inclined to play sports or take an interest in photography compared to the general population.

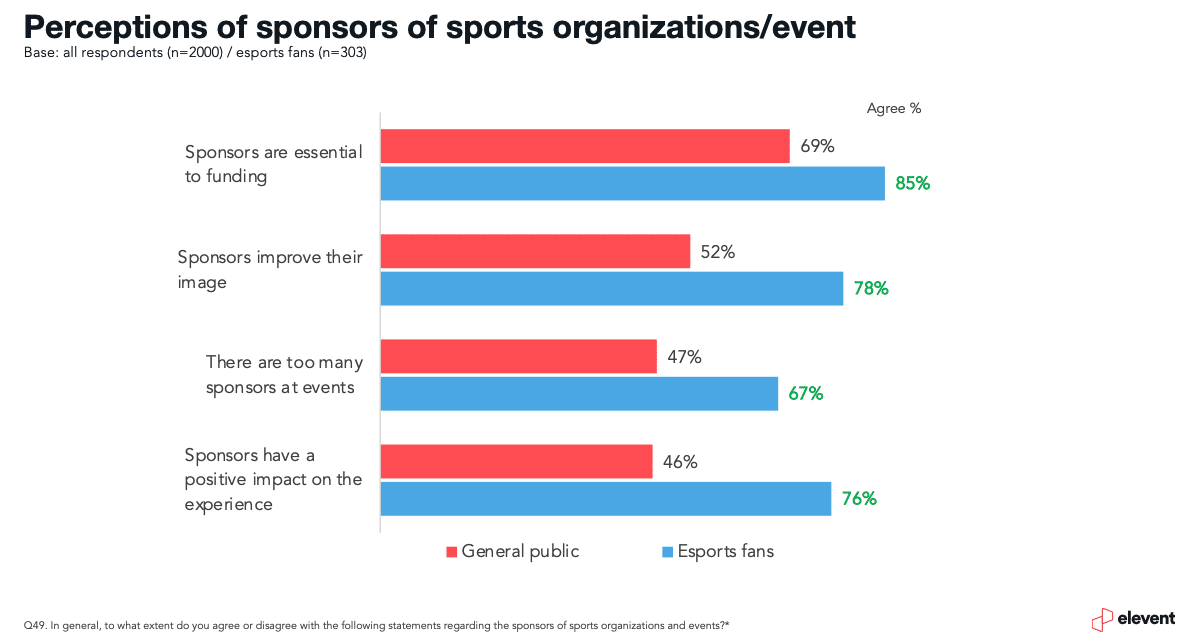

Perception of sponsors

Esports fans have a favorable view of sponsors and are more willing to engage with them than the general population. A striking 85% agree that “sponsors are essential for funding sports organizations or events,” compared to 69% of the general public—a 16-point gap.

Fans also believe that sponsors positively impact their image (+26%) and their overall experience (+30%). However, some think there are too many sponsors at events (+21%).

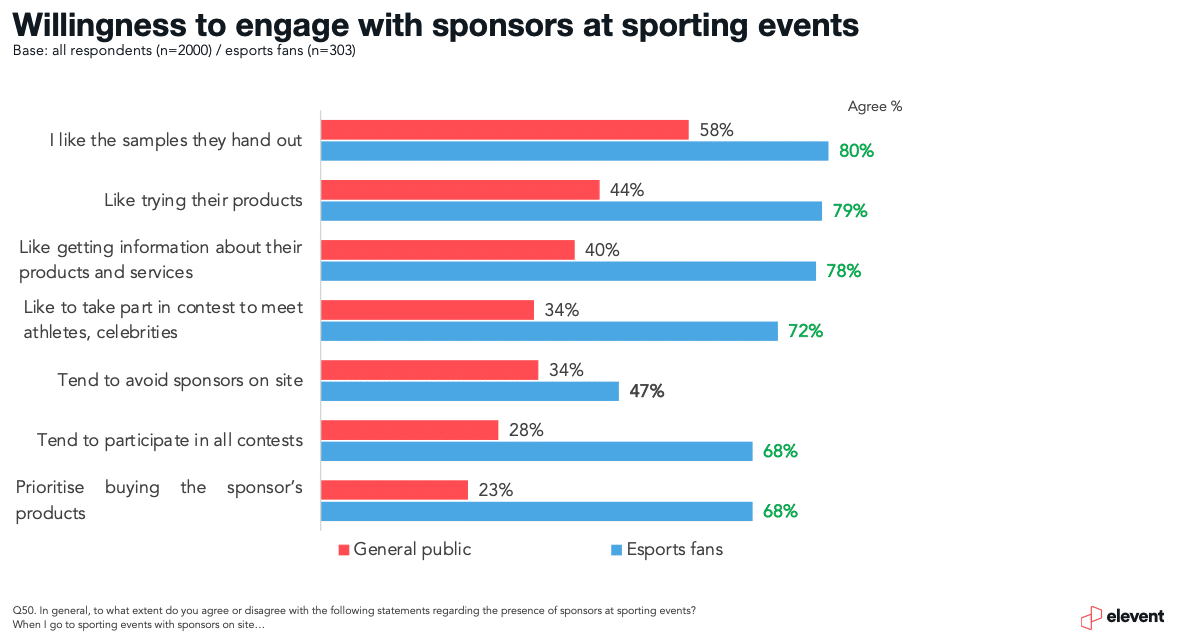

Willingness to engage with sponsors

When it comes to engagement, esports fans outshine the general population. They are much more likely to like samples (+22%), try products (+35%), seek information (+38%), participate in contests (+40%), and most importantly, prioritize buying the sponsor’s product (+45%). This level of engagement places esports fans second only to professional cycling fans.

While esports fans are eager to engage with sponsors, it may seem counterintuitive that they also overwhelmingly agree with the statement, ‘There are too many sponsors at events.’ This suggests a delicate balance that offers an interesting insight for marketers. To be effective, sponsors need to strike the right tone in their interactions with esports fans. They should also strive to understand the unique culture of each game and community to craft sponsorships that are not only relevant but also positively received by the fans.

The future of Esports

Initial excitement about esports led to significant investments, celebrity endorsements, and plans for esports-specific stadiums. Despite this, the commercial promise has not fully materialized.

Investors and sports teams are reassessing their involvement as revenues have not met expectations and expenses continue to mount. Major esports teams like Team Misfits, FaZe Clan, and Team Liquid are downsizing and pivoting their focus.

While esports offers exciting partnership opportunities, many non-endemic brands struggle to connect with this unique audience.

Small, niche properties might offer brands a better chance to engage with a highly invested audience, as opposed to bigger platforms with more passive fans.

Conclusion

Esports is far from dead. However, it should be viewed as a niche entertainment sector with a deeply engaged, yet specific, fanbase.

Methodology

Elevent conducted an online survey with 2,000 completed responses from adult Americans (aged 18 and above) in Q1 2022. The survey aimed to gain insights into the impact of sports sponsorships on American consumers. It covered a wide range of topics, including the influence of sports sponsorships, corporate social responsibility (CSR) and athlete advocacy, stadium naming rights, sports fan bases, and more. Among the respondents, 437 identified as runners (engaging in running/jogging at least once or twice a year, with the majority running/jogging at least once a week), while 343 identified as competitive runners (having participated in a competitive running race). The full survey results were weighted using Census Bureau data, considering age, gender, race, and region of residence, with a margin of error of ±2% (based on probability, with a confidence level of 95%).

To learn more about Elevent, delve into this survey on consumer perspectives regarding the impact of sports sponsorship, or arrange a demo of our Sponsorship Lifecycle Management platform, please contact us.